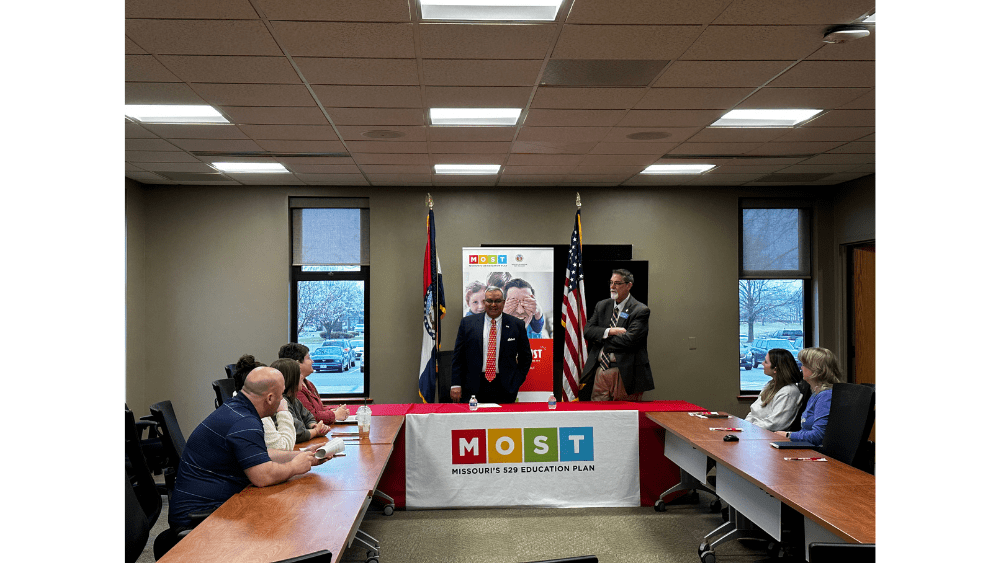

Missouri State Treasurer Vivek Malek visited President Brent Bates with State Fair Community College to promote the MOST 529 Savings Plans, which help Missourians save money for their future education needs.

“Missouri families know that it is important to make every dollar count when it comes to saving for their children’s education,” Treasurer Malek said. “Investing your income tax returns in a MOST 529 Savings Account can be wise. Even a small investment can grow in value over time without being subjected to state and federal taxes. Moreover, Missourians can enjoy a state tax deduction on their contributions to their children’s MOST 529 Savings Accounts.”

According to the IRS, the average tax refund amount has been $3,207 for the 2024 tax season. “I cannot think of a better use of those tax refunds than to invest it into a tax-free MOST 529 account,” suggested Treasurer Malek.

In Pettis County and neighboring counties near State Fair Community College, the MOST 529 program currently serves over 2,500 beneficiary accounts with assets totaling over $30 million. Across Missouri, there are over 192,000 beneficiary accounts with assets totaling $4.2 billion available for future education needs.

Families may use their investment in a MOST 529 Savings Account for tuition to a two-year or four-year college, university, trade or vocational school, registered apprenticeships, or K-12 private institutions. The funds can be used for qualifying expenses like books, supplies, room and board, and computer equipment. In addition, a recent change this year allows MOST 529 beneficiaries to transfer unused funds up to $35,000 into Roth IRAs without any tax or penalty, provided those accounts have been active for over 15 years.

Photo courtesy of SFCC